It's the SELLER's MARKET!

Home Buyers Seeking Affordability Are Expanding Search Outside Greater Seattle Job Centers

Depleted inventory continues to frustrate would-be buyers in Western Washington. Many of these potential homeowners are expanding their search beyond the major job centers in King County. Areas immediately outside the Puget Sound region and along the I-5 corridor continue to see double-digit house price growth due to first-time homebuyers who struggle to afford housing in King and Snohomish counties as well as from existing homeowners cashing out of Seattle and King County.

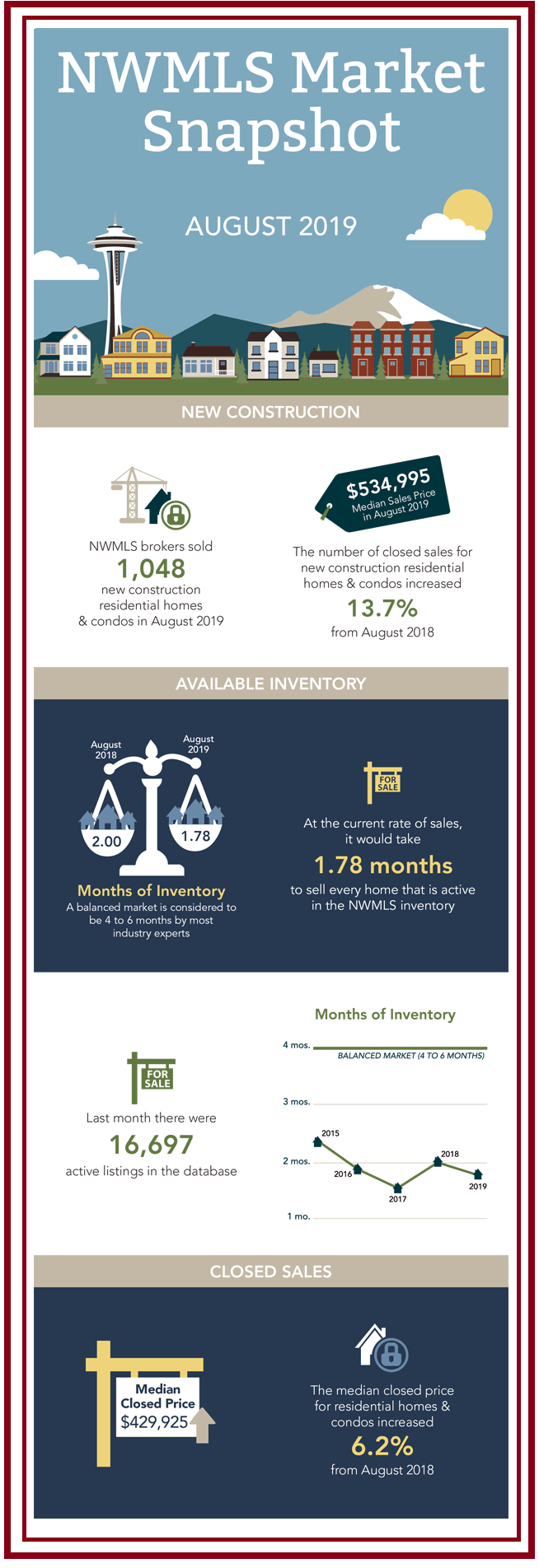

August 2019 is a Seller's market! The number of for sale listings was down 11.6% from one year earlier and down 0.5% from the previous month. The number of sold listings decreased 2.7% year over year and decreased 4.3% month over month. The number of under contract listings was up 2% compared to previous month and up 18% compared to previous year. The Months of Inventory based on Closed Sales is 1.8, down 10.1% from the previous year. The Average Sold Price per Square Footage was down 1.1% compared to previous month and up 3.2% compared to last year. Based on the 6 month trend, the Average Sold Price trend is "Depreciating" and the Median Sold Price trend is "Neutral". The Average Days on Market showed a neutral trend, an increase of 17.9% compared to previous year.

The pending sales numbers indicate that buyers are indeed out there and willing to purchase, but there are simply not enough homes. Everything that is listed is getting sold and fairly quickly. As we head into the fall market our listing inventory continues to lag last year's numbers, but we should see a bump in activity now that kids are back to school and vacations are over. Multiple offers are still commonplace with many buyers walking away disappointed. Traffic is strong at open houses and our average market time is still very low for correctly priced homes.

August property sales were down 2.7% from 8412 in August of 2018 and 4.3% lower than the 8547 sales last month. Versus last year, the total number of properties available this month is lower by 1928 units of 11.6%. This year's smaller inventory means that buyers who waited to buy may have smaller selection to choose from. The number of current inventory is down 0.5% compared to the previous month. There was an increase of 2% in the pended properties in August, with 8247 properties versus 8088 last month. This month's pended property sales were 18% higher than at this time last year

The August numbers offered a few interesting nuggets. The Seattle area housing market is still coming off the 'sugar high' that we saw last summer, but homes sales and prices are stabilizing, which is reassuring to both buyers and sellers. Buyers are drawn to areas outside King County in search of affordability. Pierce County is now experiencing what King County did 24 months ago where a surplus of buyers and lack of supply are pushing up home prices. Snohomish County also saw a big bump with a massive 16% increase in pending sales year-over-year. This tells us the secret is clearly out that housing in the counties to the north and south of Seattle is more affordable.

Prices for single family homes (excluding condos) rose 6% from a year ago, while condo prices ticked up by only about 2%. Brokers expect favorable conditions for both buyers and sellers in the coming months. As we enter the fall housing market, both interest rates and job growth in Puget Sound are extremely positive. These are both key indicators of a strong housing market. September and October are historically the best for selection and availability out of the next six months with kids back in school and summer vacations over, homeowners who wish to sell their house before the winter season will look to put their home on the market soon. Similarly, buyers can take advantage of the market timing and low interest rates in the next two months to come.

Low interest rates, strong job creation, and lifestyle changes continue to attract buyers to the market. The move-up market is very active, while acknowledging challenges for first-time home buyers. A challenge for them is assembling the down payment. We are seeing FHA and VA financing being used for low and zero down mortgages. Also, family assistance is a big help. With brokers anticipating solid activity in the next few months, sellers need to make sure their home goes on the open market in order to be exposed to as many buyers as possible. To do anything else may be leaving money on the table. Buyers, should get all their ducks in a row. Meet with a lender for pre-approval before looking for homes, be clear as to what they can live with or without in their next home, and if at all possible, use cash or a conventional loan which are more appealing to sellers in multiple-offer situations.

For FREE Online Home Evaluation,

please fill up the form below

Looking for Investment Properties?

Let us know what you need

If you have any questions or comments you would like answered in next month's newsletter, email me at [email protected] and they will be included in the market update.

OR if you would like more information on our unique systems and programs, call us at 206-391-7766 or visit our website www.GeorgeMoorhead.com

©2019. All rights reserved